Portfolio

Castle Alternative Invest's investment objective is to provide Shareholders with long term capital growth through investment in a well diversified and actively managed portfolio of hedge funds, managed accounts and other investment vehicles.

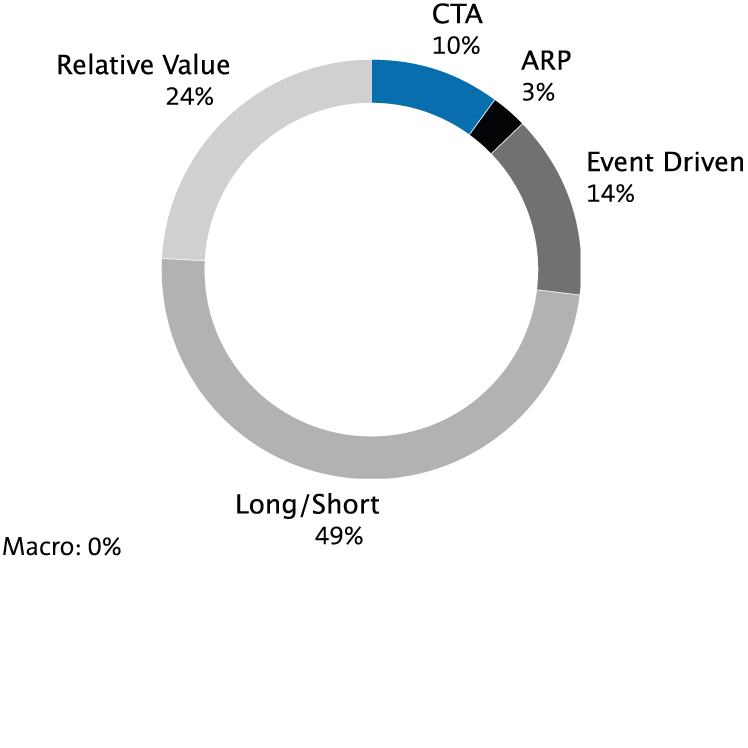

Style allocation

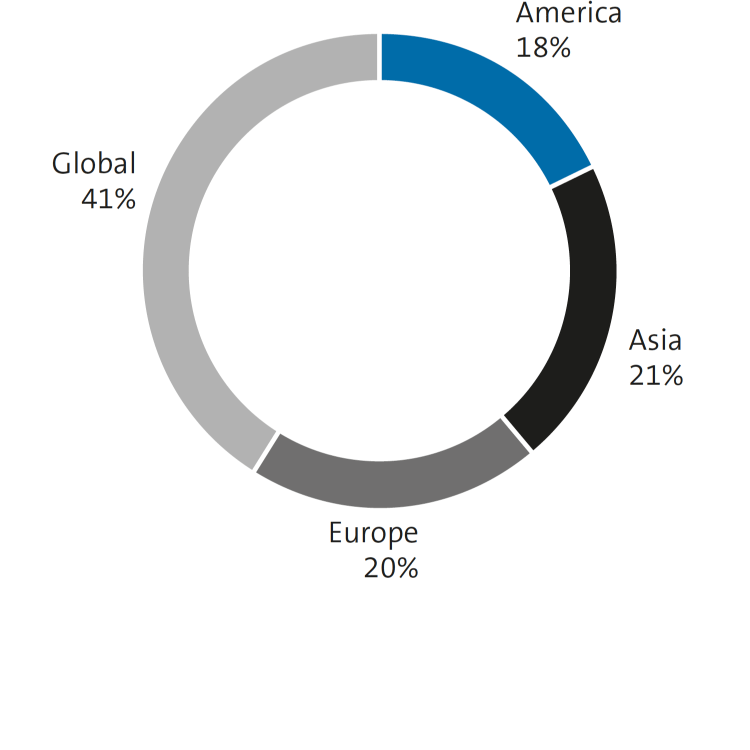

Geographical focus

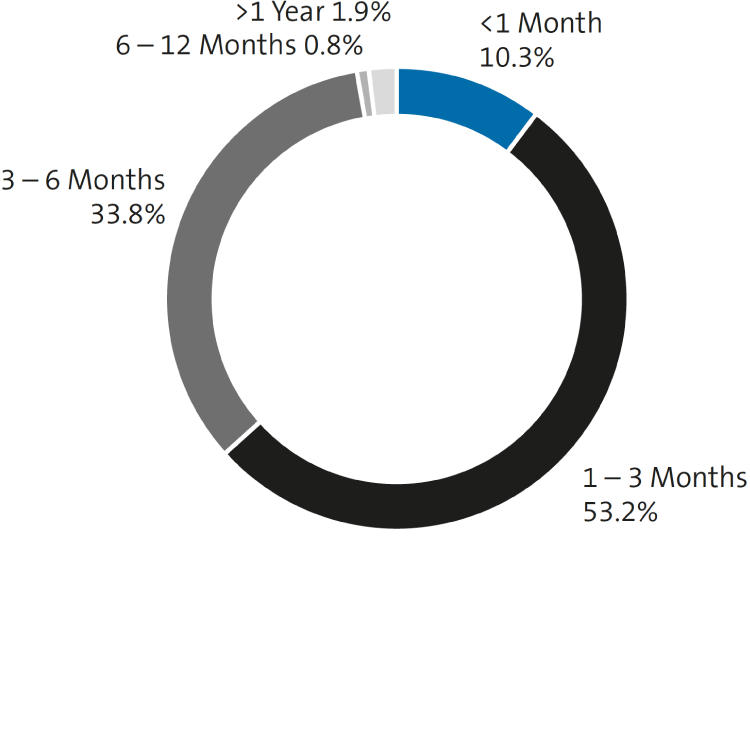

Liquidity of investment

Top and bottom money makers 2020

Fund | Style | Date of initial investment | Performance for 2020 | 2020 gain/(loss) in TUSD million |

| Crown/Linden Segregated Portfolio | Relative Value | July 2009 | 26.7% | 1,323 |

| Crown/Greenvale Segregated Portfolio | L/S Equity | November 2018 | 22.6% | 1,200 |

| Sylebra Capital Parc Offshore Fund | L/S Equity | November 2020 | 20.5% | 544 |

| CC&L Q Global Equity Market Neutral Fund | Systematic | February 2019 | (0.92%) | (35)) |

| Crown Managed Futures Master Segregated Portfolio | CTA | April 2006 | (9.32%) | (542) |

| Crown/Lomas Segregated Portfolio | L/S Equity | October 2016 | (18.17%) | (961) |

Ten largest holdings

Fund | Style | USD million 31 December 2020 | % of investments |

| Crown/Greenvale Segregated Portfolio | L/S Equity | 6.5 | 9.4% |

| Crown/Zebedee Segregated Portfolio | L/S Equity | 6.3 | 9.1% |

| Crown/Linden Segregated Portfolio | Relative Value | 5.8 | 8.3% |

| Crown/Astignes Segregated Portfolio | Relative Value | 5.5 | 7.9% |

| Crown/PW Segregated Portfolio | Event Driven | 5.4 | 7.8% |

| Segantii Asia-Pacific Equity Multi-Strategy Fund (The) | Relative Value | 5.2 | 7.5% |

| LGT Crown Systematic Trading Sub-Fund | Systematic | 5.2 | 7.5% |

| Crown/Optimas Segregated Portfolio | L/S Equity | 5.1 | 7.3% |

| Crown/Capeview Segregated Portfolio | L/S Equity | 4.5 | 6.5% |

| Aventail Energy Offshore Fund Ltd. | L/S Equity | 3.6 | 5.2% |

Subtotal of ten largest holdings | 53.1 | 76.5% | |

All other investments | 16.3 | 23.5% | |

Total net assets | 69.4 | 100.0% |

Data as per December 2020